As far as I’m concerned, a card swiper is a card swiper—I’m not paying attention to the specific logo on the device when I’m making a purchase. But what might be a pretty inconsequential difference to consumers like me will have a big impact on sellers.

Sell more and keep your customers happy

You need to make sure the processor you choose can integrate with your selling platform, that it supports the transaction types you use, and that it has the features you need. And when it comes to fees, choosing the wrong payment processor can cost you hundreds—or more, if you’re selling at scale.

Two of the most popular payment processors are Stripe and PayPal. If you’re trying to choose between the two, here’s what you need to know.

Stripe vs. PayPal at a glance

I’m just going to put the bottom line up front: Stripe is the better choice in nearly every scenario. PayPal has a seriously complicated fee schedule that adds up quickly, and even basics like a virtual terminal or a recurring payment tool require a subscription plan plus an added monthly fee. Stripe offers most of PayPal’s paid features for free or for a much cheaper per-transaction fee, and their regular fees are lower, too.

That said, you can’t put a price on the value of PayPal’s universal brand recognition. Particularly if your customer demographic skews a little older or less tech-savvy, you may find customers are more willing to input financial information via a platform they’re already familiar with. In reality, Stripe and PayPal are both equally secure, but the fact remains that some people are set in their ways and would rather forgo a purchase than adapt to a new payment processor.

Keep in mind that we’re evaluating these platforms as payment processors—not for personal money transfers or even for particularly large invoicing projects (though both platforms do have invoicing tools, which I’ll get to later on).

| Stripe | PayPal | |

|---|---|---|

| Ease of use | ⭐⭐⭐ A little trickier to set up, since Stripe’s checkout gateway must be integrated with your site | ⭐⭐⭐⭐ Very easy off-page checkout setup; customizable gateways available with upgrades are just as tricky to integrate as Stripe |

| Costs and fees | ⭐⭐⭐⭐⭐ Simple “% + fixed cost” fee schedule with uncomplicated pricing for add-ons like recurring payments and invoice management | ⭐⭐ Complicated pricing with different “% + fixed cost” fees for each type of transaction; difficult-to-parse fees for upgrade services that are required in order to access key features that also cost an additional fee |

| Recurring payments | ⭐⭐⭐⭐⭐ Recurring payment setup is included at no extra charge; users can gain access to advanced billing tools like recurring invoices for a low additional per-transaction fee | ⭐⭐ Merchants need a paid account (Payments Advanced, Payments Pro, or Payments Pro Payflow), and it costs $10/month to be able to accept recurring payments |

| Pay later options | ⭐⭐ Available via third-party integrations with high per-transaction fees | ⭐⭐⭐⭐⭐ PayPal Pay option included with no additional fees |

| International payments | ⭐⭐⭐⭐⭐ Simple, low-cost added fee for international transactions and currency conversions | ⭐⭐ Higher added fee for international transactions and currency conversions, plus base “% + fixed cost” fees have different fixed costs for each country |

| Customizability | ⭐⭐⭐⭐ Fully customizable checkout gateway included at no extra cost | ⭐⭐⭐ Customizable checkout gateway and on-site checkout options require Payments Pro ($30/month) or Payflow Pro ($25/month) accounts |

| Currencies/transfer types supported | ⭐⭐⭐⭐ All major credit cards, 135 international currencies, crypto, and ACH debit and credit transfers; Venmo transfers not supported | ⭐⭐⭐⭐ All major credit cards, 25 international currencies, Venmo transfers, and crypto; ACH transfers not supported |

What’s not different?

If you’re torn between Stripe and PayPal for your business, disregard these factors—they’re (more or less) the same on both sides.

- Credit cards accepted: Both Stripe and PayPal can accept all major credit cards.

- In-person, online, and keyed transaction capability: Both apps allow users to take orders in person, set up a checkout online, or input credit card information manually (called a “keyed transaction” or “virtual terminal transaction”). PayPal does charge a higher fee on keyed transactions, though.

- Card reader costs: Terminals (the full-scale card processor you would see at any shop counter) cost $249 for both platforms. Stripe’s handheld card readers cost $59, while PayPal charges $29 for your first reader and $79 for additional devices. Unless you need an absurd number of card readers, it more or less balances out: if you bought two card readers, it would only cost $10 more with Stripe than with PayPal.

- Chargebacks, disputes, and refunds: Both platforms’ chargeback and dispute fees are similar ($15 for Stripe, $20 for PayPal), and their refund policies are identical (no additional fees for refunds, but the original processing fees from the purchase are not refunded).

- Quality of security tools: Both Stripe and PayPal offer two-factor authentication, data encryption, advanced risk monitoring, fraud detection and prevention, and a number of other high-quality security tools. The price of these tools is a different story—we’ll go over that in a bit more detail further down.

- Reporting tools: Both platforms have decent reporting capabilities, with options to generate basic transaction reports and payout histories. PayPal’s reporting capabilities are probably slightly better than Stripe’s, but neither is so impressive that it should function as a tie-breaker.

- Integrations: Both platforms have broad libraries of apps that can be natively integrated, and both apps integrate with Zapier.

Learn more about how to automate post-purchase marketing with PayPal and how to automate your payments with Stripe.

PayPal is easy to set up and use, but Stripe allows on-site checkouts that you can customize to your brand

If you’ve ever made a PayPal purchase before, you’re familiar with the standard off-page checkout process that takes place on the PayPal site. It’s absurdly easy for the buyer—and the brand name is enough for people to trust it—but it takes you off the page you were purchasing from.

Stripe is designed to be integrated directly with your shop so that the customer remains on your website throughout the entire checkout process. It also allows you to customize the checkout gateway to match your shop’s brand and aesthetic. PayPal only offers a customizable on-page checkout flow to users with a subscription to Payflow Pro ($25/month) or Payments Pro ($30/month).

But here’s the rub: setting up an integrated checkout gateway is a little tricky in both cases, and requires some basic programming knowledge (or the patience and technological aptitude to follow a how-to video really, really closely). So if you don’t care about having a branded on-page checkout page and just want something easy, PayPal has an option for that; Stripe doesn’t.

Stripe’s setup dashboard can look overwhelming to non-coders.

That said, you can hire a freelance programmer on Fiverr to set up a checkout gateway for around $30. So if you couldn’t code your way out of a paper bag but you still want the nicer checkout experience, paying someone else to do it isn’t going to bankrupt you.

PayPal’s pay later and invoicing features are free, but nearly every other type of transaction will be cheaper with Stripe (and you won’t have to worry about hidden fees)

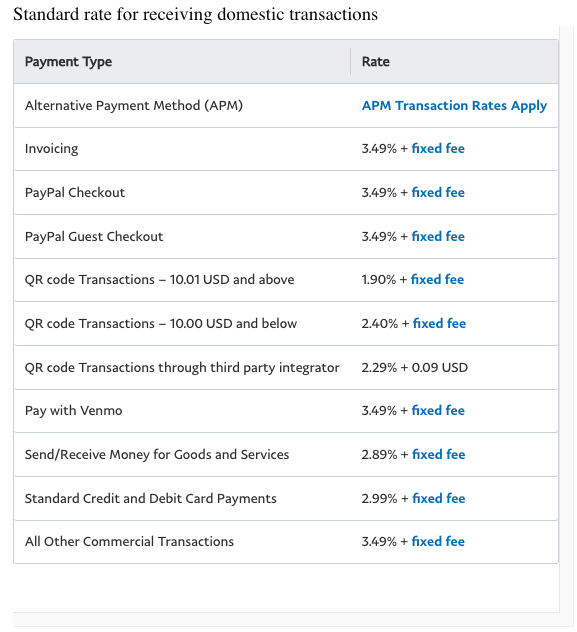

There’s no other way to put this: PayPal’s pricing structure is a nightmare. It took me, without exaggeration, hours to figure out PayPal’s fees, and that was just so I could write this post. Not only is the percentage fee different for each type of transaction, but you need to consult a different table to find the fixed fee that applies to each different payment type as well.

The specificity of the payment types PayPal lists is bananas, and there’s a different fee for almost every one.

Stripe charges 2.9% + $0.30 for online sales and 2.7% + $0.05 for sales made in person. That’s it. There are a few different fees for specific scenarios, like ACH transfers and wire payments, but the vast majority of sales will fall into one of those two categories. In addition to their blissful simplicity, Stripe fees are also cheaper than most PayPal fees.

That said, the two pricing advantages that PayPal has are its free pay-later service and its free invoicing tools. Stripe doesn’t offer a native pay-later option, but integrates with third-party platforms Affirm, Afterpay, and Klarna instead—each of which charges a hefty 6% + $0.30 fee per transaction. Invoicing with Stripe is free for the first 25 invoices per month, after which it costs an additional $0.04 per transaction. Its “Plus” invoicing option costs 0.5% per transaction, but it grants access to advanced invoicing tools that allow you to automate things like invoice collection and reconciliation.

PayPal’s paid tiers are confusing, and they require users to pay extra for features that are included with Stripe

Stripe doesn’t have tiers. It collects its fees primarily on a per-transaction basis, and those features that are considered “extras” cost a small additional per-transaction fee—usually a few cents or a few tenths of a percentage point.

As I mentioned earlier, users who want to create a custom integrated checkout gateway with PayPal need to pay to be able to do so. The Payflow Pro plan allows merchants to fully customize their shopping flows, and costs $25/month plus an added $0.10 fee per transaction. Stripe offers this same service for free.

The other paid PayPal plan is Payments Pro ($30/month). This subscription allows merchants to access PayPal’s Online Card Payment Services; however, each service costs an additional fee on top of the subscription price. These features include things like account monitoring, fraud prevention, virtual terminal access, and even the ability to accept recurring payments—which all cost an additional $10-30 per month each.

Stripe offers recurring payments, virtual terminal access, and fraud protection for free. More advanced features, like recurring invoices and advanced fraud protection, cost a small per-transaction fee; no premium subscription required.

Stripe or PayPal: Which makes sense for you?

PayPal looks like the better choice for solo operators and small business owners, primarily because its setup is so familiar. But keep in mind that most users will pay a premium for the privilege of that easy setup in the form of high fees and monthly costs for essentials like recurring billing and virtual terminal access.

To help you visualize what each service might cost in practice, here are a few basic transaction scenarios and what they would cost with each platform.

| Stripe | PayPal | |

|---|---|---|

| $100 sale, paid online via credit card | $3.20 | $3.48 |

| $100 sale, paid online using saved payment information | $3.20 | $3.98 |

| 500 sales, $100 each, paid online using saved payment information | $1,600.00 | $1,990.00 |

| $20 monthly recurring payment, paid online via credit card | $.88/month | $61.09/month (transaction fee plus Payments Pro subscription and recurring billing tool access) |

| 500 monthly recurring payments, $20 each, paid online via credit card, with advanced fraud protection in place | $450/month | $634/month (transaction fees plus Payments Pro subscription, recurring billing tool access, and fraud protection) |

If you’re only making a handful of sales per month and you aren’t selling big-ticket items, the difference between Stripe and PayPal’s fees will be manageably small. But once you start selling at scale, in almost all scenarios, PayPal is going to cost you a few hundred dollars more than Stripe per month. The main barrier to entry for Stripe is its more complicated setup that requires a developer to install.

Source :

https://zapier.com/blog/stripe-vs-paypal/